An example of a NI number is AB123456D. Employees come within the ambit of Class 1 National Insurance contributions once their earnings reach the lower earnings threshold.

But if your income is between 9569 and 50270 you are required to pay 12 of your earnings.

. National Health Insurance Overview. Are some of the attractive features of National health insurance policies. National Insurance number starts with 2 letters followed by 6 numbers and are finished off with a letter A-D.

However the calculation method and the full scope of NI is often mis-understood. This system can help those without enough years of contributions already made to claim the state pension. National insurance is a deduction made to employees earnings and is often seen as running along side tax deductions.

National Insurance - your National Insurance number how much you pay National Insurance rates and classes check your contributions record. Tax benefits cashless benefits add-on covers overseas coverage etc. From 2011 the HMRC no longer issue cards and where replaced with an official letter.

If you purchase this insurance we will receive a commission that is a percentage of the premium. PAYE tax and Class 1 National Insurance contributions. However contributions are paid at a notional zero rate between the lower earnings limit and the primary threshold.

Figures for how much the increase in National Insurance will cost were updated to take into account the rise in the primary threshold from April 2022 in line with inflation. Unless otherwise stated these figures apply from 6 April 2019 to 5 April 2020. HMRC has confirmed the 2022-23 National Insurance NI rates in an email to software developers.

Supplements are added in most months. The CPS ASEC is designed to give annual national estimates of income poverty and health insurance numbers and rates. B The Primary Threshold sometimes called the Primary Earnings Threshold If you earn between the Primary Threshold and the Upper Earnings Limit then you will pay the standard rate of National Insurance 12 in 202122 on your earnings over the Primary Threshold.

National Insurance contributions NICs are the UKs second-biggest tax. The tables below show the earnings thresholds and the. This remains at 120 per week for 202122 520 per month.

His total NIC for the week are 9628. Johns employer adds to this with 138 of 834 or 11509. The next 796 is paid at 12 totalling 9552 and the last 38 requires 2 contribution 76p.

NICs-inclusive cost to the employer. For certain Veterans the VA National Income Threshold based on previous years gross household income andor net worth is used to determine eligibility for Priority Group 5 assignment and cost-free VA health care. The insurer comes with vast network hospital facility where one can avail cashless benefits PAN India.

The Primary Threshold is 184 per week in 202122. It allows those people to make voluntary payments to top up the amount of National Insurance they have paid so that they can reach the threshold so they may still claim the full state pension if they so desire. Ask us for more details before we provide you with services.

What are voluntary NIC. National Insurance rates and thresholds for 2022-23 confirmed. Health related insurance premiums including Medicare premiums diabetic supplies private caregivers incontinence.

Australian Unity Health Insurance is promoted by National Seniors Australia Ltd ABN 89 050 523 003 as an authorised representative of Australian Unity Health limited ABN 13 078 722 568. You normally operate PAYE as part of your payroll so HMRC can. It collects information about income and health insurance coverage during the prior calendar year.

Health insurance policies are highly sought because of their unique features and benefits offered. Isle of Man NI numbers will always start with the prefix MA. For employed people National Insurance NI threshold is 9569 for the tax year 2021-22.

National Insurance is calculated based on a. The CPS ASEC is conducted in February March and April. John earns 1000 per week the first 166 is under the national insurance threshold and he doesnt pay any NIC on it.

Between the primary threshold and the UEL for example the 12 employee NICs rate and 138 employer NICs rate mean that NICs are 2580 12 employee NICs 1380 employer NICs for each 11380 the employer pays out. This means if your income is 9568 or below during the 2021-22 tax year then you are exempted from you do not have to pay paying National Insurance.

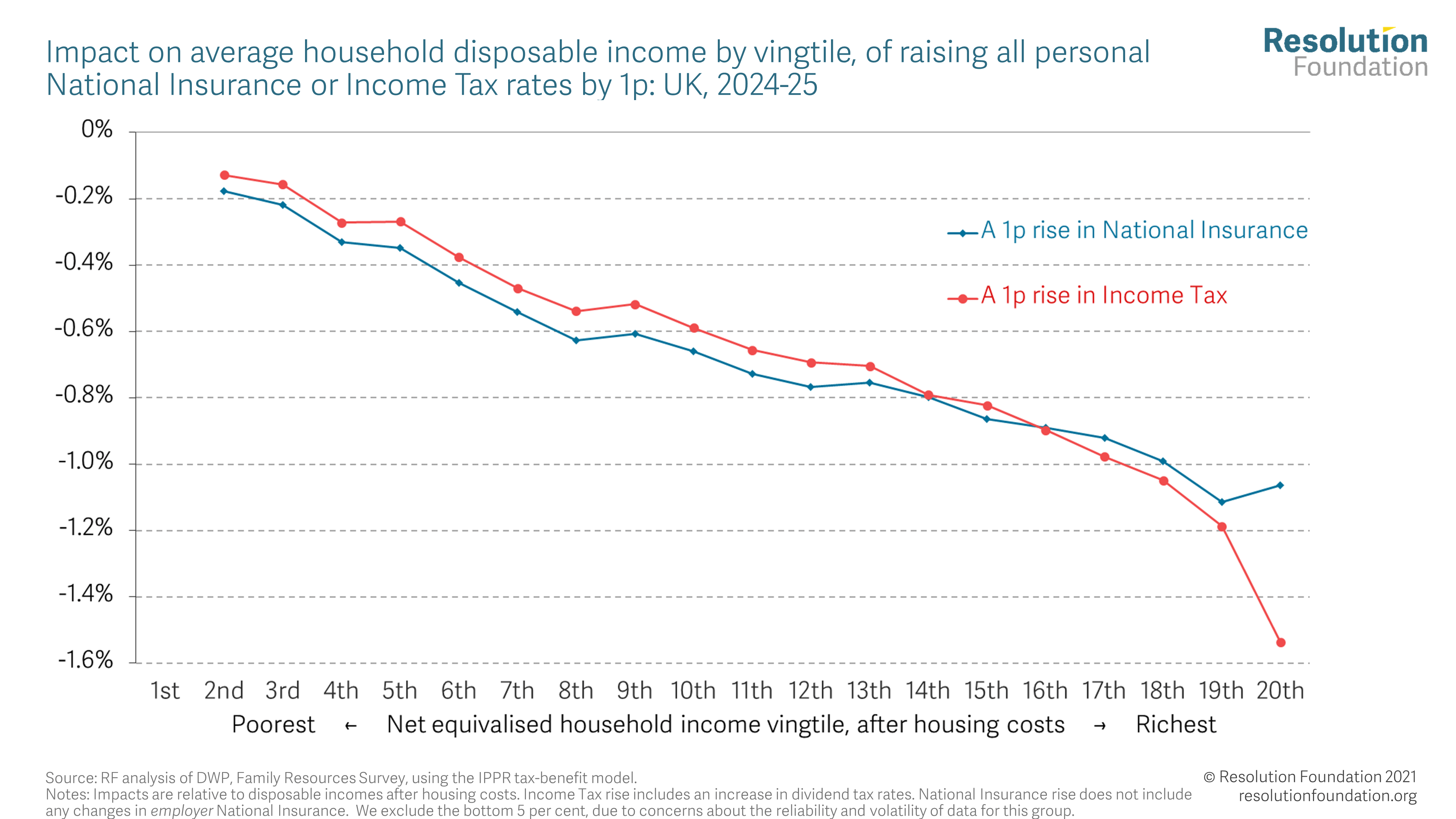

A Caring Tax Rise Resolution Foundation

Self Employed National Insurance What To Pay If You Re Self Employed Https Www Simplybusiness Co Uk National Insurance Refinance Mortgage Mortgage Advice

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

A Caring Tax Rise Resolution Foundation

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff